Investment strategy

Targeting investments in single-asset continuation funds.

AltEx aims to create a portfolio of high-quality investments in single-asset continuation vehicles, backed by leading private equity firms looking to extend the hold period of their best-performing assets to continue generating growth.

Investment criteria

GP / management alignment Target deals where the GP is making a meaningful investment and company management maintains significant ownership.

Company quality Invest in successful assets that have attractive growth prospects, generate recurring revenue and are recession resilient.

Industry quality Focus primarily on healthcare, business and consumer services sectors, in which Imperial Capital has deep experience.

GP quality Partner with proven private equity firms with long-term track records.

Keys for Success

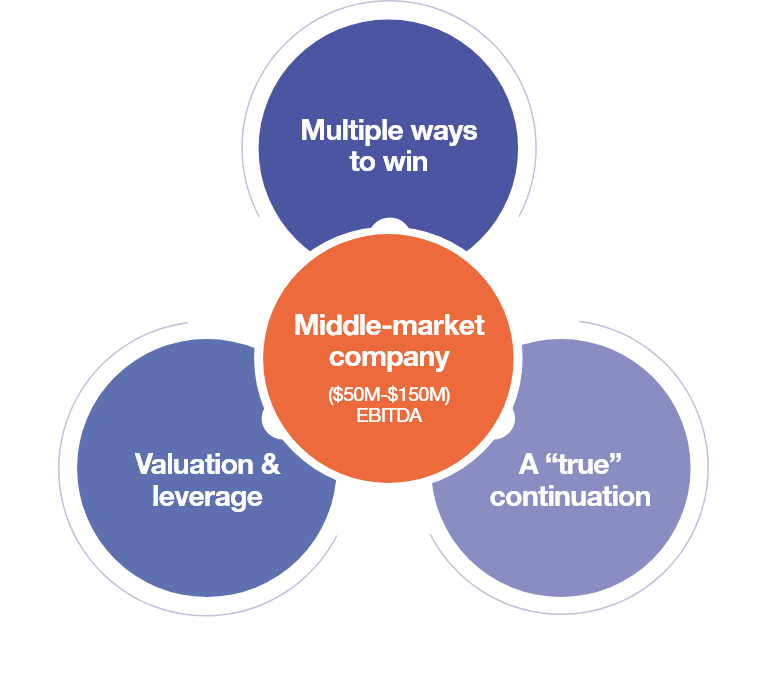

Multiple ways to win

The company must have multiple levers to generate returns: Free Cash Flow, Growth, and M&A opportunities. While we do not assume any valuation multiple expansion at exit in our base case assumptions, we always seek opportunities with an idiosyncratic path to achieving multiple expansion over time.

Disciplined approach to valuation and leverage

Appropriate entry valuation and avoiding excessive leverage are critically important to the success of each deal. We apply a bottoms-up valuation methodology to all of our prospective investments.

Continuation of a proven value creation strategy

We look for assets that are “true” continuation opportunities. (No resets or restarts). GPs must demonstrate that the underlying fundamentals of the value creation roadmap can be extended.

How AltEx Capital is different

Deep diligence capabilities

AltEx approaches every investment as if we were a direct investor, leveraging Imperial Capital’s deep experience conducting comprehensive due diligence across hundreds of deals to ensure we only back true trophy assets.

Industry focus

We are solely focused on the healthcare, business and consumer services industries and benefit from the research capabilities, relationships and domain expertise that come from Imperial Capital’s decades of investment activity in these areas.

Middle-market focus

AltEx is primarily focused on investing in North American service-based business with US$50-US$150 million of EBITDA. We believe this area of the market provides the most compelling opportunity for high-quality single-asset CVs.

Highly selective

AltEx seeks to invests in six to eight single-asset CVs for Fund I, which makes us highly selective in the market and a unique secondary fund that provides our investors with concentrated exposure to high-quality single-asset CVs.

Want more information about single-asset continuation vehicles?

Get informedWant to learn more?

We’d love to hear from you.

Thank You.

We have received your inquiry.